It’s Tax Day. Inequality is greater than ever.

What would a progressive global tax actually look like? In his clear, accessible companion to Thomas Piketty’s Capital in the Twenty-First Century, economist Jesper Roine explains.

from Pocket Piketty:

In the fourth and final part of Capital in the Twenty-First Century, Piketty attempts to draw lessons for the future based on the historical trends he observes. Given that the single greatest mechanism for leveling out income and wealth over the twentieth century was war and destruction of capital, rather than a natural tendency for inequality to go down as the economy develops, and given that inequality now appears to be rising, he asks what we can do about it. Can we imagine political institutions that might regulate today’s capitalism justly as well as efficiently? Or do we have to wait for the next crisis or, in the worst case, the next war?

The ideal policy according to Piketty would be to introduce a progressive global tax on capital. Such a tax would also have the benefit of generating more information and transparency about the size and distribution of wealth. In addition, Piketty believes it would promote the general interest over private interests while preserving economic openness and the forces of competition. The alternative, as he sees it, is a trend toward increased protectionism and a less dynamic economy. Piketty states that a global tax on capital is utopian, but cooperation between a limited number of countries could be an effective alternative.

In discussing the options, it is important to understand the role of the state in supporting fundamental social rights and to understand how taxation in society has evolved. The key points of Chapter 13 [of Capital in the Twenty-First Century] are that the size of the state in terms of the burden of taxation grew during the twentieth century and that the role of the state has remained more or less the same over the past few decades. The discussion of future reforms is thus not about changing the size of the state, in the first instance. As ever, there are considerable variations from country to country but, in broad terms, countries such as Sweden and the United States have more commonalities than differences. The state’s primary undertakings in areas such as health care and pensions, and, above all, the role of education in ensuring that everyone has equal opportunities, are based on principles of social justice, and there are no obvious arguments either for reducing or increasing these undertakings. There are, though, many good reasons for reforms in various directions, with different countries facing differing challenges. With respect to the long-run challenges in focus here, it is not the basic role of the state nor the size of the government that needs to change.

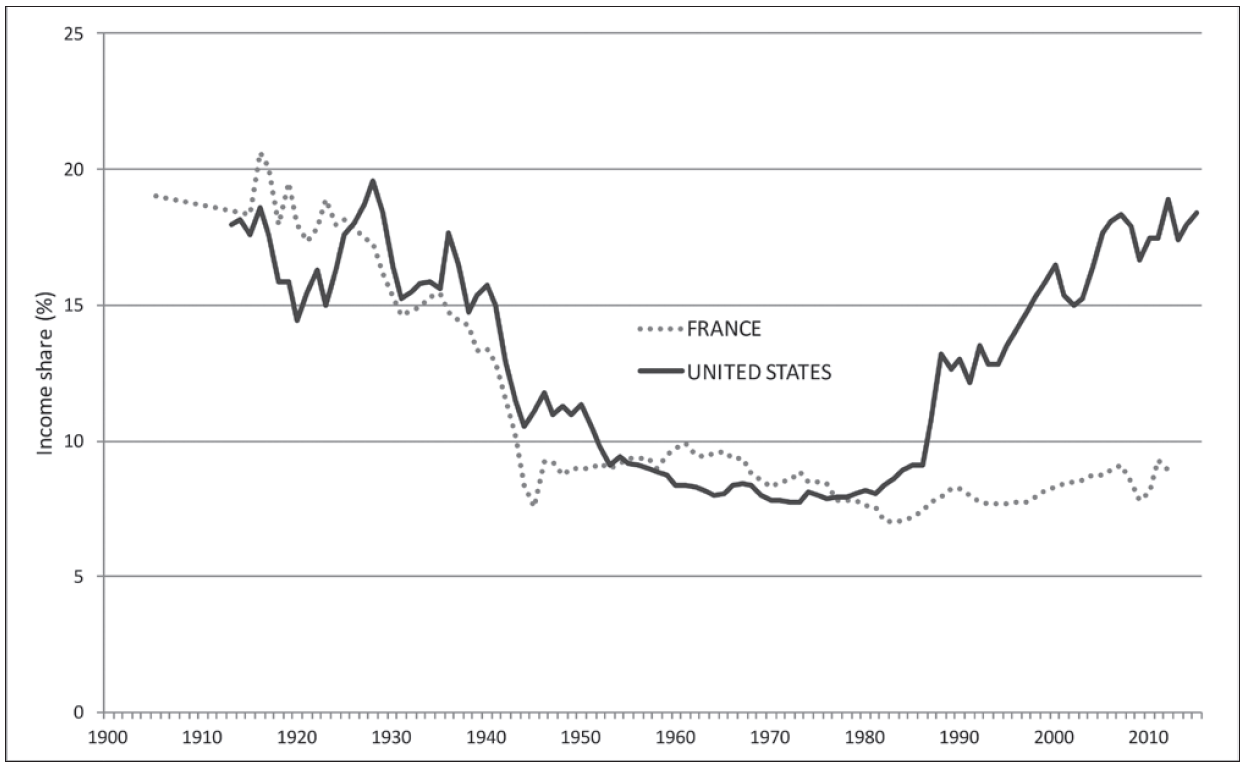

Chapter 14 discusses the structure of taxes and the specific idea of a progressive tax on both income and inheritances. Once again, Piketty looks to history and finds that the wars in the first half of the twentieth century played a central role in the creation and evolution of taxes. It is true that many countries introduced progressive income tax in the late nineteenth and early twentieth centuries, but the levels were very low, and only rose dramatically with the advent of the First World War. He also notes that Britain and particularly the United States were much more progressive than many European countries in introducing high tax rates on high incomes and large inheritances. Many people in the United States were concerned about the huge wealth inequalities of the early twentieth century, and felt that the trend threatened the very foundations of American society. A heavy progressive inheritance tax was an obvious solution to stop a trend in which wealth inequality had become “undemocratic,” with the United States steadily becoming more like inheritance-dominated Europe, according to leading economist Irving Fisher, for example.

For decades, both during and after the war, the United States and Britain had the most progressive tax systems, with top rates of around eighty to ninety per cent on incomes, compared with levels of around fifty to sixty percent in France and Germany. Around 1980, however, there was a radical change. The top rates in Britain and the United States fell to thirty to forty percent, while the rates in France and Germany remained more or less the same. These changes in the top marginal tax rate show a close correlation with the income share of the top one percent. The countries with the greatest reductions in the top marginal tax rate have also seen the greatest increase in top salaries. Piketty sees no signs of this leading to increased productivity. He does, however, find it plausible that a top manager who only receives a small share of any wage increase above a certain level has much less incentive to hike up his or her salary than someone who retains the majority of any such increase. Piketty thus sees raising the top marginal tax rate as the most obvious solution to reign in the extreme executive salaries found primarily in the United States. He is, however, not particularly optimistic about the chances of such a change occurring. The egalitarian and pioneering ideal of American society has been lost and the New World may be on the verge of becoming the Old Europe of the

twenty-first century, as he puts it.

In Chapter 15 of Capital, Piketty discusses the proposal that he sees, at least in terms of principle, as the best way to check the spiral of increasing inequality we otherwise risk getting caught up in—a progressive global tax on capital. Despite it being utopian, he thinks it useful as a standard against which other, more realistic, alternatives can be measured. So, if we ignore the practicalities for a moment, what would the tax look like in principle? To start with, the tax would be applied to net wealth, which is the value of all assets (financial and nonfinancial) minus debt. The rate might be in the order of zero percent for net assets of less than one million euros, one percent for assets of one to five million and two percent above five million. It is important to note that such a tax would differ from the related taxes that are already applied in many countries. In contrast to property taxes, for example, the tax on capital takes account not only of real property but all assets, and it is also not based on the value of the asset, but on net assets. A person in debt should not pay the same amount as a person with no debt. When it comes to revenue from the tax (disregarding practical issues and potential evasion), it should never generate more than modest revenues, a few points of national income perhaps. The primary point of the tax is not to provide a source of revenue, but to rein in the spiral of inequality that otherwise risks occurring, and at the same time create a clear picture of wealth ownership in society. The latter point is important, since it is hard to discuss a number of leading issues when knowledge about the ownership of wealth is so difficult to obtain. It is also important to note that a tax on capital in many ways complements income taxes and inheritance taxes in what might be called the ideal tax system. To illustrate just one of many points: imagine that a wealthy person has a fortune of ten billion and that over the course of a year this increases in value by five percent (500 million). In economic terms this means that the person has received an income of 500 million, since economic income is defined as the amount a person can afford to spend during a given period, and be as well-off at the end of it as at its beginning. In practice and for tax purposes it is, however, more likely that the person in question will declare an income that is a fraction of this, say five million, and pay tax on that. This is not tax evasion, simply a reflection of the fact that without a complementary tax on capital, it is probable that extremely wealthy individuals will, in practice, only pay tax on a very small part of the economic income they receive.

Could such a tax be introduced, if not globally, then perhaps at European level? Thomas Piketty sees no reason why not. A system of the type outlined above, with a tax rate of 0.1 percent on net wealth below 200,000 euros, for instance, and 0.5 percent on wealth of between 200,000 and 1 million, would be able to replace property tax (where it exists), which is practically a wealth tax on the propertied middle class. A system that also then applied a tax rate of one percent on wealth of between one and five million euros, and two percent on anything above that, would generate revenues in the order of two percent of Europe’s GDP. Such a system would, of course, require changes to Europe’s political institutions, but it would be the best way to tackle the increasing concentration of wealth and its consequences.

Further Reading

POCKET PIKETTY

A Handy Guide to Capital in the Twenty-First Century

How many of Piketty’s groundshaking concepts have gone unappreciated, all for want of intellectual stamina? Written in clear and accessible prose by an experienced economist and teacher, in this handy and slim volume, Jesper Roine explains all things Piketty. More |

CREDITOCRACY

And the Case for Debt Refusal

In this forceful, eye-opening survey, Andrew Ross contends that we are in the cruel grip of a creditocracy – where the finance industry commandeers our elected governments and where the citizenry have to take out loans to meet their basic needs. More |

THE CANDIDATE

Jeremy Corbyn’s Improbable Path to Power (2nd Edition)

In June 2017 an earthquake shook the very foundations of British politics. With Labour widely predicted to suffer a crushing defeat in the general election, Jeremy Corbyn instead achieved a stunning upset—a hung parliament, the humiliation of Theresa May’s government, and more than 40% of the vote. More |